Making Specification Safer: The BBA and NBS

24 March 2025

See how a partnership between the BBA, RIBA & NBS helps heighten safety standards from the earlie...

09 September 2022 | By NBS

As we approach the last quarter of 2022, attention will start to turn to planning for 2023 for many manufacturers. We've picked out five key areas from the Construction Manufacturers' Marketing Report that you may wish to consider during your planning process for next year.

As we approach the last quarter of 2022, attention will start to turn to planning for 2023 for many manufacturers. There are many factors you may be considering, including what you want to achieve in 2023, and what budget you will need to achieve it. We thought it was timely to look back at our NBS Manufacturers’ Marketing Report 2022, which we released at the start of the year. Within the report, 166 manufacturers and suppliers – often senior figures – from at least 136 different companies shared their approach to marketing. Here we pick out five key areas you may wish to consider during your planning process for 2023.

You will be monitoring the external factors that impact on your marketing and, at the moment, things are changing by the day. Within the construction marketing report (based on a survey of suppliers in late 2021), three out of four saw materials shortages as likely to have a negative influence. And since the survey was carried out, we have seen spiralling energy prices further compounding the problem and contributing to very high levels of inflation, especially for construction materials. Clearly this represents a major challenge for many suppliers and their customers.

The economic outlook is uncertain, with recent falls in GDP and construction output and talk of recession. In times such as these, it can be difficult to make plans. Perhaps the best approach is to focus on what you can control, including continuing to monitor the marketing environment so you are ready to act. Also, we might take some heart that recent reports suggest that, at least until recently, there has still been some optimism among architects . On top of that, GDP rose slightly in July and inflation fell in August . However, the implications of last week’s mini budget also need to be considered, such as the drop in the value of the pound, and the view from the Bank of England is that we might already be in a recession.

But looking at more positive trends in the Manufacturer’s Marketing Report, the majority of respondents cited both increased digitalization and sustainability as likely to have a positive influence. These present opportunities to use digital channels alongside more traditional approaches to reach and collaborate with specifiers, and to communicate aspects of your products that demonstrate strong environmental credentials, such as recycled content, recyclability, low embodied carbon or enablers of low operational carbon. Despite the challenging economic environment, focusing on further developing your digital channels and sustainability information (for instance with Environmental Performance Declarations (EPDs)) could help to differentiate your offer to specifiers and constructors, as well as to promote a more sustainable economy.

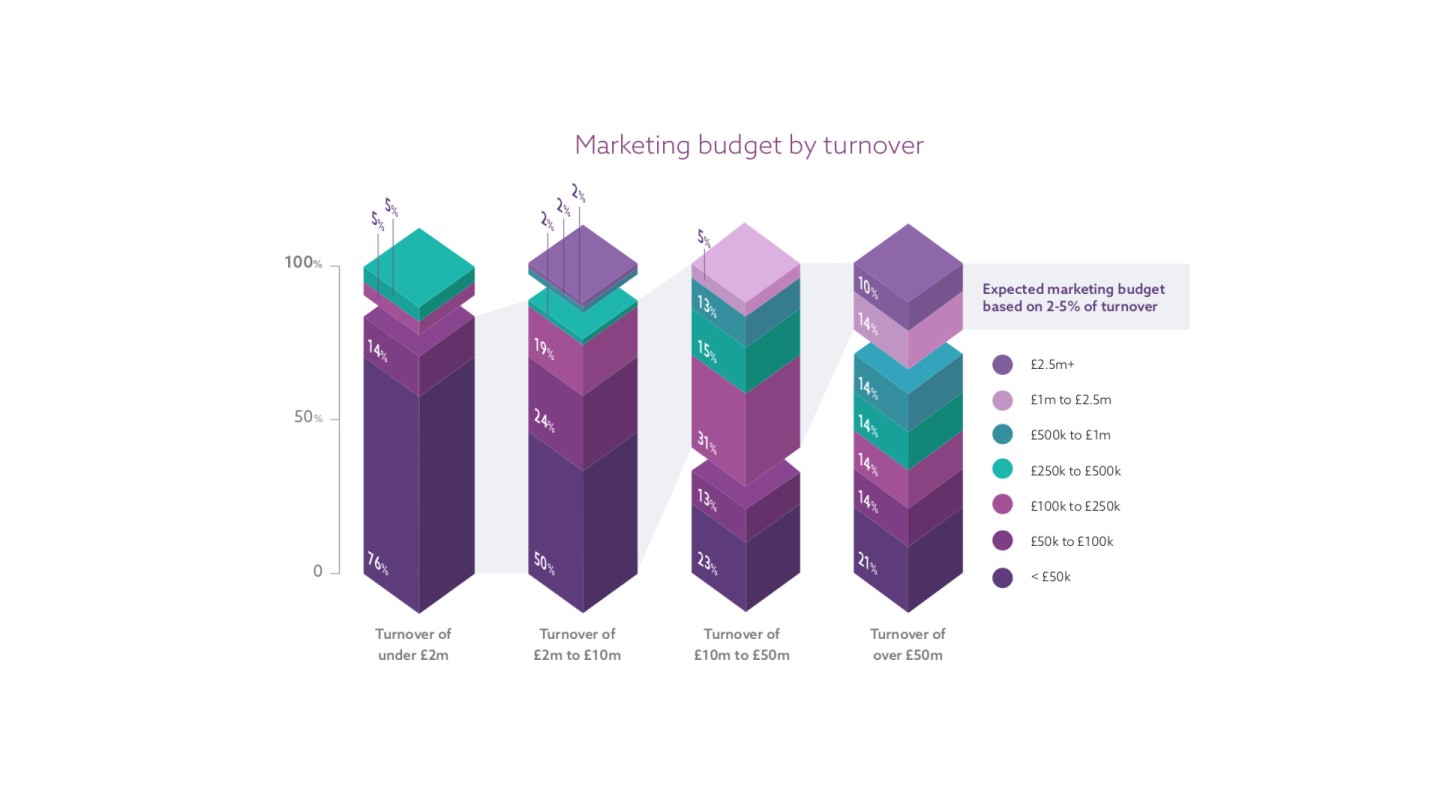

A lot of the decisions you make will centre around the marketing budget you have available to you. Often, though not always, budgets are set based on a percentage of sales (or turnover). We found low marketing budgets in the construction industry, with more than half of respondents telling us that their current budget at the end of 2021 was under £100 000.

On average, we found that marketing budgets stand at 2.3% of turnover; however, there was significant variation, with some companies spending less than 1% and others more than 35%. Often it was the larger companies that were spending less than expected on their marketing. Setting the right budget is important to ensure you can achieve your marketing aims and objectives.

With the recent uncertainty highlighted above, it can be tempting to reduce marketing budgets, but the experience of the past often shows that companies who continue to invest in marketing during difficult times come out the other side in better shape. It seems like a lot of manufacturers are keen to maintain or increase their budgets where they can: our report showed that in recent years, more of you have increased your budgets (29%) than decreased them (18%), while 52% kept them the same, despite the current economic climate.

In our survey, we found that both digital and more traditional approaches continue to have a place, though digital marketing is the most commonly used – with over half of respondents’ budgets allocated to it, on average. While there is a trend towards digital marketing, in-person contact can still be very valuable, as can the ability for specifiers to handle physical samples of products before specifying them.

Construction-tailored approaches to marketing, such as libraries of technical data and project leads services, represented about a fifth of marketing budgets. Through NBS Source, you can provide your company information, product data, specifications and digital (BIM) objects – all in a structured, searchable and filterable interface. And through Glenigan, you can track projects as they progress and assess their likely suitability as targets for your products. NBS and Glenigan are now working together to link together product and project data – find out more about how this can support your marketing strategy.

Your choice of approach will depend on your budget, your product and who you are looking to target with your marketing, but it is worth noting that some channels provide an opportunity to track where leads originated and make it easy to add your product data directly into a project. For instance, specifiers can easily add your product specification data from NBS Source directly into the specification in NBS Chorus – just by clicking the 'add to spec' button.

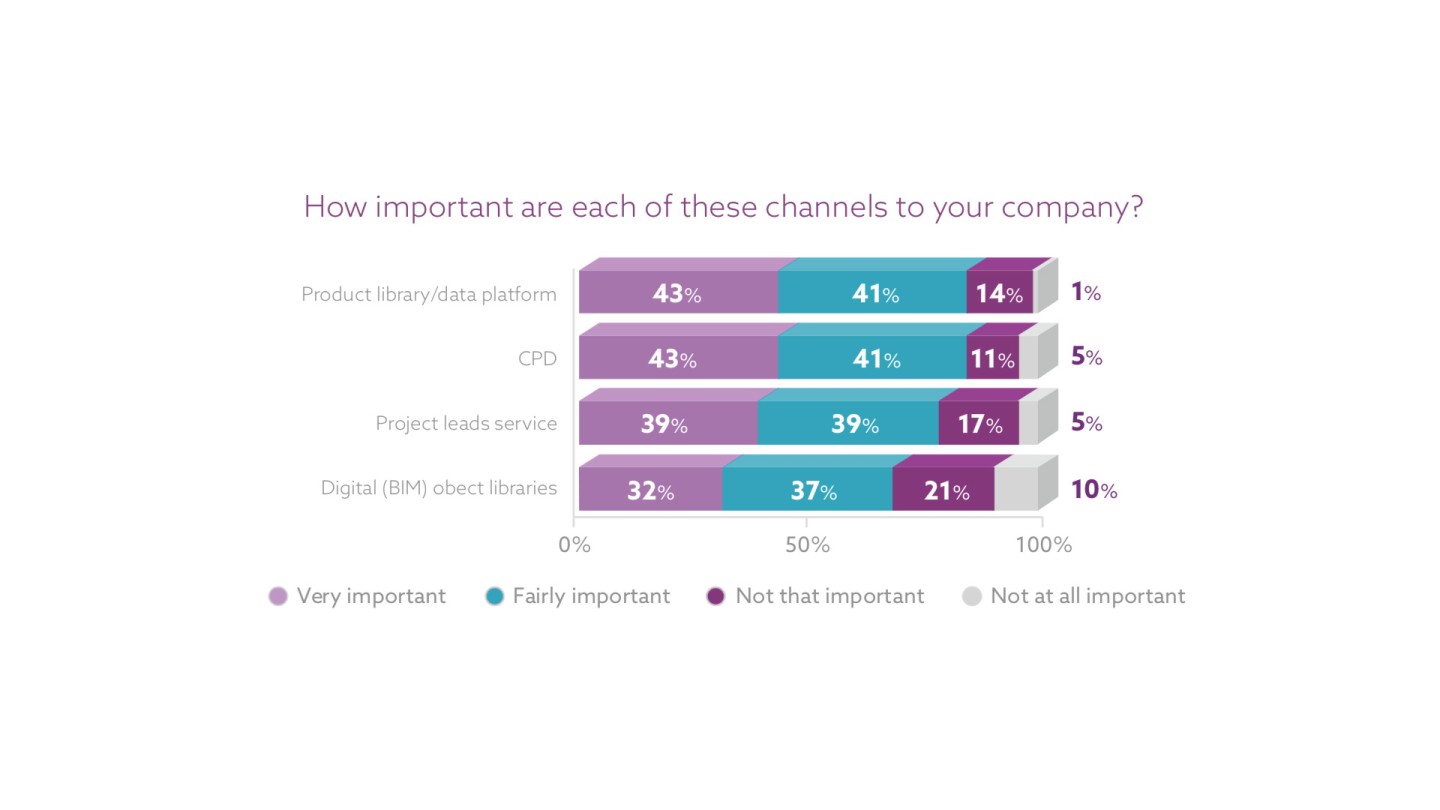

Unsurprisingly, our research found that there was universal use of manufacturers’ websites and social media. Many companies also utilizing digital brochures or catalogues. But how important are the various construction-tailored marketing channels? We saw that the four construction-tailored channels we put to respondents – product libraries/ data platforms, continuing professional development (CPD), project leads services and digital (BIM) object libraries – were all important to a greater or lesser extent.

The demand for manufacturers to provide accurate, up-to-date and transparent information about their products is only likely to increase, in order to meet the requirements of the Building Safety Act and help the project team to realize the golden thread of information. The new Code for Construction Product Information (CCPI) also requires high standards of product information. Structured data platforms like NBS Source ensure that product data is provided in a way that is easy for specifiers to find, interpret and compare. NBS Source also encourages the provision of sustainability data.

In addition to NBS Source, we have recently launched a new service: NBS Partner Marketing. There are multi-channel marketing options available to help you reach thousands of specifiers. Whether you aim to raise awareness of your brand and products or drive new leads, we offer a range of opportunities, from webinar sponsorship packages to brand advertising on newsletters and social media.

It can also be useful to think about what tools and resources you use to assist you in your marketing and management of construction product information. In terms of marketing tools, results show that social media tools are most used, followed by email marketing systems. We found that the management of construction product information continues to happen predominantly through PDF documents, followed by spreadsheets.

If data is held in PDF documents, it is important to be mindful that, as static documents, they go out of date; therefore, they need to be reviewed regularly to make sure that customers are not using incorrect information. Users of construction product information need to know and have confidence in the accuracy and currency of the data.

As well as a portal to surface and showcase your products to specifiers, NBS Source can also help you to manage your product information.

Download the report to learn more about how the construction industry is applying marketing, the strategies and tactics being used, and how this compares to your company’s approach and what you may wish to consider going forward.